Running out of medication isn’t just inconvenient-it can be dangerous. And when you’re paying hundreds of dollars a month for prescriptions, missing a refill can also mean losing control of your budget. If you’re managing chronic conditions like diabetes, high blood pressure, or depression, you know how easy it is to let costs pile up without realizing it. The good news? You don’t need a hospital IT team to set up a system that keeps your meds on hand and your spending in check. Here’s how to build a simple, personal medication budgeting and auto-refill alert system that works with what you already have.

Start with a Realistic Medication Inventory

Before you can budget, you need to know exactly what you’re spending on. Grab your pill bottles or prescription labels and list every medication you take regularly. Include the name, dosage, how often you take it, and the cost per fill. Don’t forget over-the-counter drugs you use daily, like pain relievers or antacids. If you’re on a specialty drug like Humira or Enbrel, note the price-it could be $500 to $3,000 per month. Write down how often each prescription is refilled: every 30 days? 90 days? Every six months?Now add up the monthly cost. If your insulin costs $120 every 30 days, that’s $360 a month. Your blood pressure med is $45 every 90 days? That’s $15 a month. Add them all. This number is your baseline. If you’re surprised by how high it is, you’re not alone. A 2023 survey found that 61% of Canadians with chronic conditions spend over $200 a month on prescriptions, and many don’t track it closely.

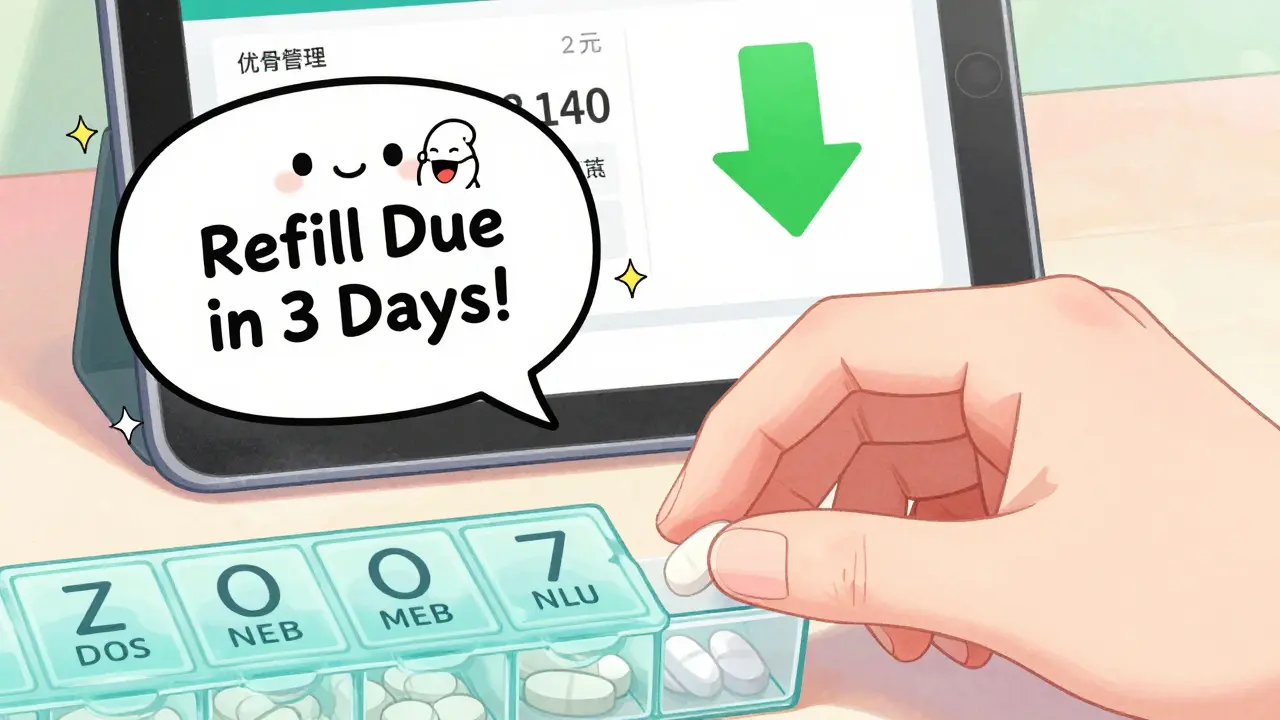

Use Your Pharmacy’s Digital Tools

Most major pharmacies-Shoppers Drug Mart, London Drugs, Walmart, or your local independent pharmacy-offer free online accounts or apps. Sign up if you haven’t already. Once logged in, you’ll see your prescription history and refill status. Here’s the key step: turn on auto-refill alerts. In the app, find the setting for “automatic refills” or “reminders.” Enable it for every prescription you take regularly. Most systems will send you a text or email when your prescription is due, usually 7-10 days before you run out.Don’t just rely on the alert. Set a calendar reminder on your phone for the same day. Why two? Because if the pharmacy’s system glitches (yes, it happens), your phone alarm won’t. One user in Ottawa told us she missed her refill because the pharmacy’s system was down during a snowstorm. Her phone alarm saved her from going two days without her thyroid med.

Build a Monthly Medication Budget

Now that you know your monthly drug costs, treat them like rent or groceries-non-negotiable. Open your banking app or use a free budgeting tool like Mint or YNAB. Create a category called “Prescriptions” and assign your total monthly cost to it. If your meds cost $420 a month, that’s $420 you can’t spend on dining out, new clothes, or impulse buys. This isn’t about restriction-it’s about clarity. You’re not cutting back; you’re protecting your health.Pro tip: If your insurance changes your copay, update your budget immediately. A $10 increase on one med can add $120 a year. Track every change. You’ll spot trends-like when a generic version drops in price or when a new brand comes out that’s cheaper with coupons.

Set Up Alerts for Price Drops and Generics

Drug prices change constantly. A medication that cost $150 last year might now be $80 after a generic version hit the market. Use free tools like GoodRx or Canada’s Drug Price Comparison (CDPC) to check prices weekly. Set a Google Alert for your medication name + “price drop” or “generic available.” When you get a notification, call your pharmacy and ask if they can switch you. Most pharmacists will do it at no extra charge.Some insurers also offer therapeutic interchange programs. If your brand-name drug has a cheaper, clinically equivalent alternative, your pharmacist can suggest it without a new prescription. Ask them. You might save $200 a month. One person in Toronto switched from a brand-name antidepressant to a generic and saved $2,400 a year-money they used to pay for physiotherapy.

Track Waste and Overstock

How many unused pills are sitting in your cabinet? If you’ve switched medications or stopped a treatment, those old bottles are money wasted. Every month, do a quick audit. Take out expired or no-longer-needed meds and dispose of them safely. Many pharmacies offer free take-back bins. Don’t just toss them in the trash.Also, avoid over-ordering. Some people refill 90-day prescriptions early because they’re worried about running out. But if you refill too soon, you might end up with two bottles of the same drug. That’s not just clutter-it’s money lost. Use your auto-refill alerts to time your refills precisely. If your last refill was on January 5, don’t request another until late February. Your body doesn’t need extra pills. Your wallet does.

Use Your Doctor’s EHR Portal

If your doctor uses an electronic health record system like Epic or MyChart, log in. You’ll see your prescription history, refill requests, and sometimes even cost estimates. Some portals let you request refills directly. Others show you how much your insurer paid versus what you paid. This transparency helps you spot billing errors. One user found a $180 charge for a med they never picked up. They called the pharmacy, got a refund, and adjusted their budget.Plan for Unexpected Costs

Medications don’t always go as planned. A new diagnosis, a dosage change, or a drug shortage can spike your costs. Build a small buffer into your budget-$50 to $100 a month-just in case. Put it in a separate savings account labeled “Medication Emergency.” If you don’t use it, roll it over. If you do, you’re covered without going into debt.

What Doesn’t Work (And Why)

Many people try to use spreadsheets or sticky notes. They start strong, then fall off after a few weeks. Why? They’re manual. They don’t sync with your pharmacy. They don’t send alerts. You need automation. That’s why the system above works: it uses tools you already have-your phone, your pharmacy app, your bank app-and connects them in a way that requires less than 10 minutes a week to maintain.Another myth: “I’ll just pay cash to save money.” Sometimes that’s true-GoodRx coupons can make cash prices cheaper than insurance copays. But not always. If you’re on a high-deductible plan, your insurer might be paying more than you think. Always compare cash vs. insurance price before paying.

Real Results, Real People

A 68-year-old retiree in Ottawa used this system after her husband’s diabetes meds jumped from $80 to $210 a month. She set up auto-refills, started using GoodRx, and switched to a generic insulin. Within three months, she was saving $1,300 a year. She used the extra money to replace her old hearing aids.A single mom in Calgary tracked her child’s ADHD meds and noticed they were refilling every 28 days instead of 30. She adjusted the alert and saved two extra pills a year-$45 saved, no one noticed, but it added up.

These aren’t tech experts. They’re regular people who just got organized.

Next Steps: Your 7-Day Action Plan

- Day 1: List every medication you take, with cost and refill schedule.

- Day 2: Sign up for your pharmacy’s app and turn on auto-refill alerts for all prescriptions.

- Day 3: Add your total monthly drug cost to your budgeting app.

- Day 4: Check GoodRx or CDPC for price drops on your top 3 meds.

- Day 5: Call your pharmacy and ask if any drugs can be switched to generics.

- Day 6: Clean out expired meds and dispose of them safely.

- Day 7: Set a monthly reminder on your phone to review your medication budget and alerts.

You don’t need fancy software. You don’t need to be a financial planner. You just need to start. And the best time to start is now-before your next refill is due.