Starting in 2025, Medicare drug coverage changed in ways that could save you thousands. If you’re on Medicare and take prescription meds, this isn’t just fine print-it’s life-changing. The old "donut hole" is gone. Your out-of-pocket costs for drugs are now capped at $2,000 per year. That means no matter how expensive your medications are, you won’t pay more than that in 2025. And if you’re on insulin, you pay no more than $35 for a 30-day supply. These aren’t promises-they’re rules in place right now.

How Medicare Part D Works in 2025

Medicare Part D is the part of Medicare that covers prescription drugs. It’s not offered directly by the government. Instead, private insurance companies run the plans, but they must follow strict rules set by Medicare. In 2025, every Part D plan has the same basic structure: deductible, initial coverage, and catastrophic coverage-with no gap in between.

First, you pay a deductible. For 2025, the maximum deductible is $590. Some plans have lower or even $0 deductibles, but those often come with higher monthly premiums. Once you hit your deductible, you pay 25% of your drug costs. The plan pays 65%, and the drug manufacturer kicks in 10%. That’s it. No surprise bills. No sliding into a coverage gap where prices spike.

Once your total out-of-pocket spending hits $2,000 for the year, you enter catastrophic coverage. At that point, you pay nothing for covered drugs for the rest of the year. The plan pays 60%, the manufacturer pays 20%, and Medicare pays 20%. This cap applies only to what you pay for covered drugs-premiums, non-covered drugs, and pharmacy fees don’t count.

Who Gets Extra Help?

If your income is low, you might qualify for Extra Help-a federal program that pays for Part D premiums, deductibles, and copays. In 2025, you can earn up to $21,870 as a single person or $29,580 as a couple and still qualify. That’s higher than most people think.

Extra Help isn’t just a discount. It’s a full subsidy. If you get it, you pay no more than $4.50 for generic drugs and $11.20 for brand-name drugs. You also don’t have to worry about the deductible or the $2,000 cap-Extra Help covers those too. About 14.5 million Medicare beneficiaries get Extra Help, but many more could. The application is simple: you can apply online at SSA.gov, call Social Security, or ask your local SHIP counselor.

Plan Choices Are Shrinking-But Advantage Plans Are Growing

In 2025, you’ll have about 48 Part D plan options on average. That sounds like a lot, but it’s down from 51 in 2024. Stand-alone prescription drug plans (PDPs) are disappearing fast. There are now only 14 PDPs available on average per region, down from 21 in 2024. Meanwhile, Medicare Advantage plans that include drug coverage (MA-PDs) are exploding. There are 34 of them now-up from 32 last year-and they make up more than half of all Part D enrollees.

Why does this matter? Because MA-PDs bundle your hospital, doctor, and drug coverage into one plan. If you’re healthy and don’t take many meds, a PDP might be cheaper. But if you’re on multiple prescriptions, an MA-PD often ends up being simpler and sometimes cheaper overall. The trade-off? You’re locked into a network. If your favorite pharmacy isn’t in-network, you’ll pay more-or have to switch.

What You Need to Do Before December 7

Every year, from October 15 to December 7, you can switch your Part D plan. Most people don’t. In fact, 83% of beneficiaries just get auto-renewed into their current plan. That’s risky. Plans change every year-formularies, networks, premiums, and costs.

Here’s what to check:

- Is your medication still covered? Formularies change. A drug you took last year might be moved to a higher tier or dropped entirely.

- Is your pharmacy in-network? Some plans have narrow networks. A 10-minute walk to your pharmacy might now be a 45-minute drive.

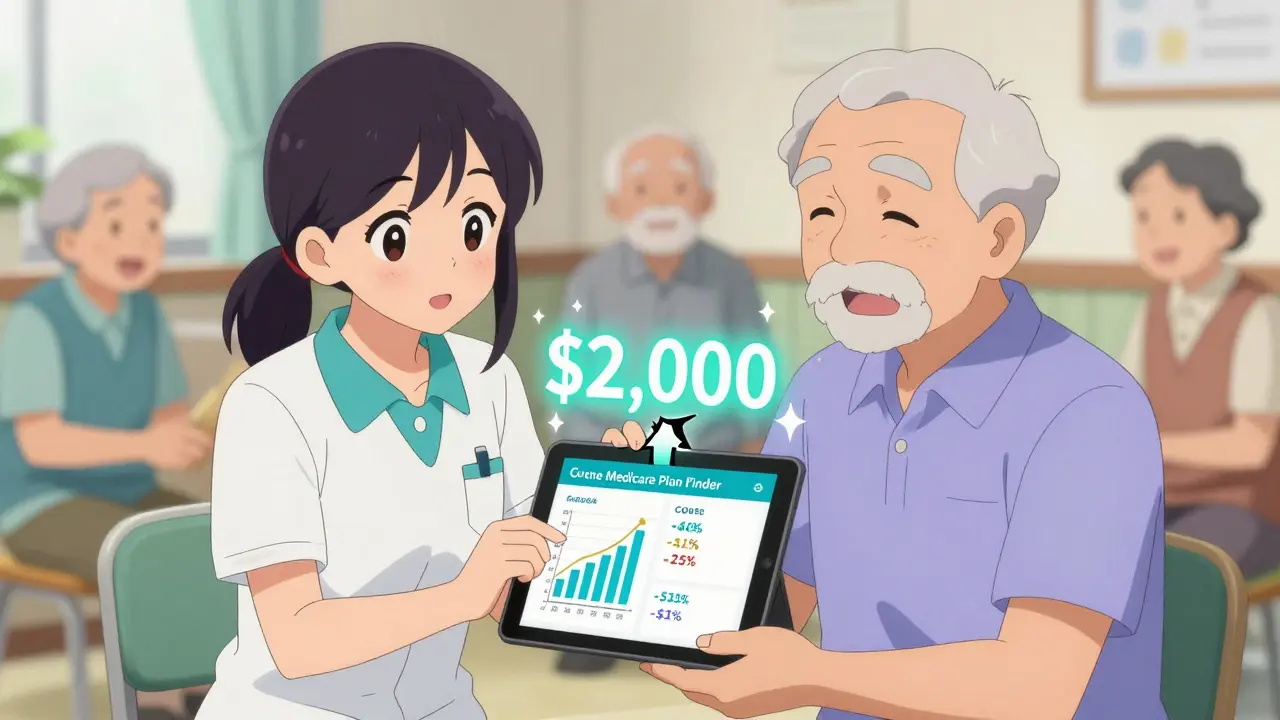

- What’s your total annual cost? Don’t just look at the premium. Add your estimated drug costs (based on your meds) plus the deductible and copays. Use the Medicare Plan Finder tool. It’s free, official, and lets you plug in your exact drugs.

- Do you qualify for Extra Help? Even if you didn’t last year, your income might have changed. Apply anyway. You can get it retroactively.

Most people spend 3 to 5 hours researching. It’s worth it. One woman in Florida saved $4,200 in 2025 just by switching from a PDP to an MA-PD that covered her cancer meds at $0 after the cap. Another man in Texas avoided a $1,800 surprise bill because he caught his insulin was no longer covered under his old plan.

Common Mistakes and How to Avoid Them

People mess up in predictable ways.

- Mistake: Assuming your plan won’t change. Fix: Review your plan every year-even if you like it.

- Mistake: Thinking premiums are the only cost. Fix: Your out-of-pocket drug costs matter more. A $10 premium plan with a $500 deductible and 40% coinsurance could cost more than a $50 premium plan with $0 deductible and 25% coinsurance.

- Mistake: Not knowing what counts toward the $2,000 cap. Fix: Only what you pay for covered drugs counts-premiums, over-the-counter meds, and drugs not on your plan’s formulary don’t count.

- Mistake: Waiting until December to act. Fix: Start in October. You have time. Use SHIP counselors-they’re free, local, and trained to walk you through this.

There are 13,500 SHIP locations across the U.S. They don’t sell plans. They don’t get paid by insurers. They just help you understand your options. Call 1-800-MEDICARE or visit medicare.gov to find yours.

What’s Coming in 2026

The $2,000 cap increases to $2,100 in 2026 due to inflation. That’s still a massive improvement over the $7,400 cap in 2023. The government is also working on a new tool for the Medicare Plan Finder that will show you your total drug cost across all plans-not just premiums and copays, but estimated annual spending based on your exact meds. That should make comparisons even easier.

Drug manufacturers are now required to pay more toward your costs during the initial coverage phase. That’s why the 10% manufacturer discount is locked in. Some worry this could push list prices up, but so far, data shows beneficiary savings are real. AARP estimates diabetic beneficiaries saved an average of $1,150 per year just from the $35 insulin cap.

Bottom Line

If you take prescription drugs, Medicare Part D in 2025 is the most affordable it’s ever been. The $2,000 cap is a safety net. Extra Help is a lifeline. The $35 insulin cap is a win for millions. But none of it works if you don’t check your plan. Don’t assume. Don’t wait. Don’t guess. Use the tools. Talk to a counselor. Make sure your meds are covered. Make sure your pharmacy is in-network. Make sure you’re not paying more than you have to.

You’ve paid into this system your whole working life. Now it’s time to use it right.

What counts toward the $2,000 out-of-pocket cap in Medicare Part D?

Only what you pay out of pocket for covered drugs counts: your deductible, copayments, and coinsurance. Monthly premiums, drugs not on your plan’s formulary, and purchases made at pharmacies outside your plan’s network do not count. This means you can pay thousands in premiums and still not reach the cap-but if you’re on expensive medications, you’ll likely hit it.

Can I switch Medicare Part D plans anytime?

No. You can only switch during the Annual Enrollment Period (October 15 to December 7) unless you qualify for a Special Enrollment Period. Those include moving out of your plan’s service area, losing other drug coverage, or qualifying for Extra Help. Outside those windows, you’re locked in until next year.

Is Extra Help the same as Medicaid?

No. Extra Help is a federal program run by Social Security to help with Medicare Part D costs. Medicaid is a state-run program for low-income people that covers broader health services. You can qualify for both, but they’re separate. Extra Help is easier to get and only applies to prescription drug costs.

What if my drug isn’t on my plan’s formulary?

You’ll pay full price out of pocket, and it won’t count toward your $2,000 cap. Talk to your doctor about alternatives on the formulary. You can also request a formulary exception from your plan. This requires a letter from your doctor explaining why you need the drug. Plans must respond within 72 hours for urgent cases or 7 days for non-urgent ones.

Do all Medicare Part D plans cover the same drugs?

No. Each plan has its own formulary-a list of covered drugs. But all plans must cover at least two drugs in each major therapeutic category. For example, if you take an anticonvulsant for seizures, your plan must cover at least two options in that class. You can’t be denied coverage for essential drugs, but you might have to pay more for brand names if generics are available.

Can I get help comparing plans?

Yes. Free, unbiased help is available through State Health Insurance Assistance Programs (SHIPs). They have counselors in every state who can walk you through your options, compare formularies, and help you apply for Extra Help. Call 1-800-MEDICARE or visit medicare.gov to find your local SHIP office.