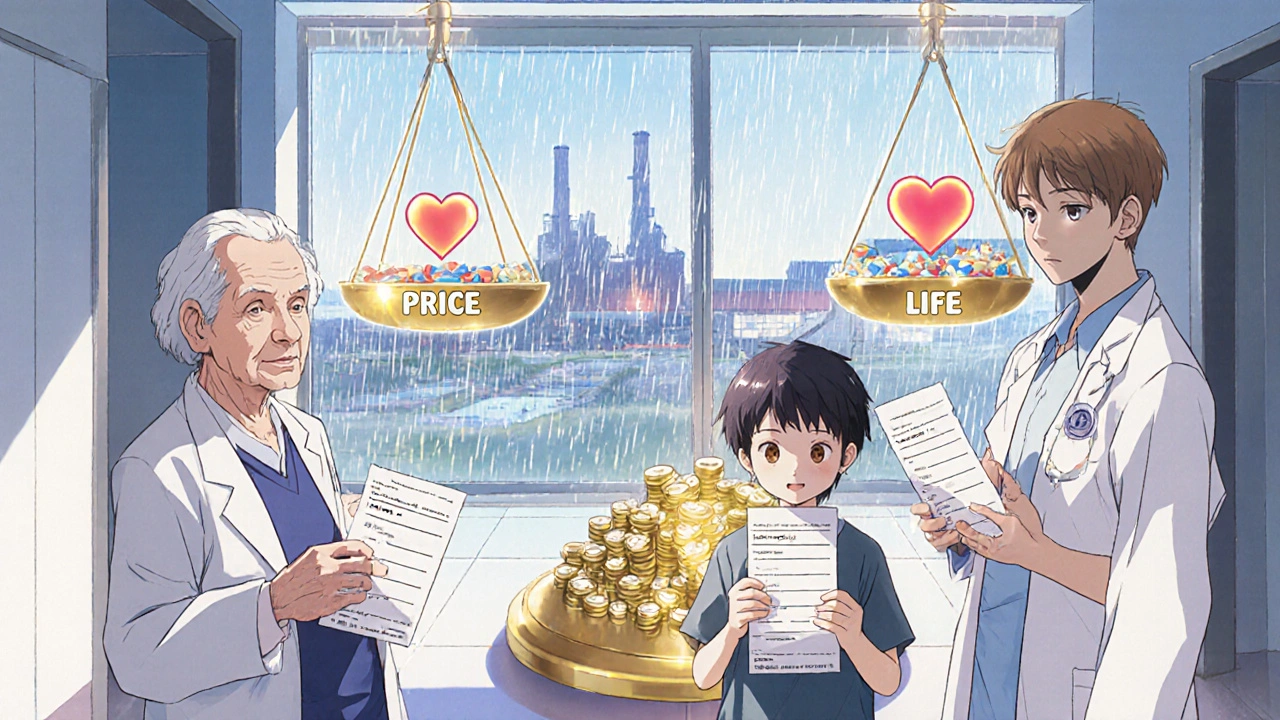

By 2023, generic drugs made up 90% of all prescriptions filled in the U.S. But they only accounted for about 20% of total drug spending. That’s the problem. The cheaper something is, the harder it is to make it reliably. And right now, essential medicines like antibiotics, heart drugs, and even epinephrine are vanishing from shelves - not because no one makes them, but because no one can afford to make them anymore.

The Price That Broke the System

Generic drug makers don’t compete on quality. They compete on pennies. A single tablet of a common generic antibiotic might sell for $0.002. That’s two-tenths of a cent. When a hospital buying group awards a $50 million contract, the difference between winning and losing is often less than a penny per pill. Manufacturers have no room for error. No room for investment. No room to upgrade equipment or hire more inspectors.This isn’t just about greed. It’s about survival. When a new company enters the market and offers the same drug for half a cent cheaper, everyone else has to follow - or lose the contract. Over time, prices drop below the cost of production. Companies lose money. They shut down. And when they do, there’s often no backup.

Take Akorn Pharmaceuticals. In February 2023, it went bankrupt and stopped making dozens of critical generics overnight. No warning. No alternative suppliers. Hospitals scrambled. Patients went without. That’s not an accident. It’s how the system works.

Where Your Medicine Is Made - And Why That Matters

About 97% of the active ingredients in U.S. antibiotics come from outside the country. For antivirals, it’s 92%. For the top 100 generic drugs, 83% have no domestic source. Most of these ingredients are made in India and China. The U.S. now produces only 14% of its own active pharmaceutical ingredients (APIs). In 2010, that number was 35%.Why? Because it’s cheaper. Building a single FDA-approved manufacturing plant in the U.S. costs between $250 million and $500 million. In India or China? $50 million to $100 million. The time to get approved? Three to five years in the U.S. - maybe one year elsewhere.

But here’s the catch: quality control isn’t the same. In 2022, the FDA found enormous and systematic quality problems at Intas Pharmaceuticals in India. Their cancer drug cisplatin was pulled from U.S. shelves. It wasn’t an isolated case. Between 2021 and 2022, FDA audits showed U.S. manufacturers had 95%+ accuracy in batch records. Some foreign facilities? As low as 78%.

And when something goes wrong? The FDA can’t force a company to make more. They can only call and ask nicely. That’s it.

The Supply Chain That Can’t Be Fixed

Your generic pill doesn’t come from one factory. It’s stitched together across continents. The active ingredient is made in India. The filler is mixed in Germany. The coating is applied in Mexico. The packaging is done in China. Each step adds risk - delays, miscommunication, contamination, paperwork errors.During the pandemic, China shut down factories. India banned exports of acetaminophen. Suddenly, millions of Americans couldn’t get painkillers or fever reducers. This wasn’t a glitch. It was predictable. The system was designed to be fragile - because it was built to be cheap, not resilient.

Even small disruptions ripple outward. A single contaminated batch can trigger a recall that wipes out months of production. And if you’re already operating at 5% profit margins? You can’t afford to stockpile. You can’t afford to wait. You just stop making it.

Why Branded Drugs Don’t Have This Problem

Branded drugs have patents. That means one company makes it. No competition. They charge more. They make 70-80% gross margins. They invest in their own factories. They keep extra inventory. They have backup suppliers. If something breaks, they fix it - because they can afford to.Generics? Dozens of companies make the same drug. No one owns it. No one has an incentive to protect it. The moment one company raises prices even slightly, another jumps in with a cheaper version. The race to the bottom is endless.

It’s like having 100 gas stations selling the same fuel. One cuts prices to $2.50. Then another to $2.40. Then $2.30. Soon, no one can afford to buy the pipes, hire the staff, or refill the tanks. The whole system collapses.

Who’s Really to Blame?

It’s not one villain. It’s a chain of decisions.- Group Purchasing Organizations (GPOs) - They negotiate contracts for hospitals based on price alone. Quality and reliability? Not part of the scorecard.

- Pharmacy Benefit Managers (PBMs) - They decide which generics get covered. Often, it’s the cheapest option - even if it’s from a factory with a history of violations.

- The FDA - They inspect foreign plants less often than they should. In 2023, 72% of U.S.-approved drug facilities were overseas. But the FDA’s budget for inspecting them only went up 12% - while the number of foreign sites jumped 40%.

- Government policy - For decades, the focus has been on lowering drug costs. No one asked: What happens when no one can make the drugs anymore?

There’s no conspiracy. Just bad incentives. And the people who pay the price? Patients.

What Happens When the Medicine Vanishes

A nurse practitioner in Ohio told Medscape she had to switch 89 patients off their generic levothyroxine because it wasn’t available. Each switch required blood tests, dose adjustments, and close monitoring. Some patients got sick. Others had anxiety. One woman went three weeks without her thyroid medication - and ended up in the ER.On Reddit, a hospital pharmacist wrote: “We’ve had to switch antibiotics for 17 different infections in six months.” Some alternatives are less effective. Some cause more side effects. Some aren’t covered by insurance.

And when the generic disappears, patients are forced to buy the brand-name version - if they can afford it. One Medicare beneficiary saw his monthly cost for a heart medication jump from $10 to $450. That’s not a price increase. That’s a crisis.

Studies show generic drugs made overseas are linked to 54% more serious adverse events - including hospitalizations and deaths - than those made in the U.S. That doesn’t mean all foreign-made drugs are dangerous. But it does mean the risk is higher. And no one is telling patients.

Is There a Solution?

There are ideas. But they’re slow, small, and underfunded.- The FDA’s Emerging Technology Program has approved 12 new continuous manufacturing facilities since 2019. These can produce drugs faster, with better quality control. But they account for less than 3% of total generic production.

- Bipartisan bills in Congress propose tax breaks for U.S.-based API manufacturing. But they’re stuck in committee.

- Some hospitals are bypassing GPOs and buying directly from manufacturers. That’s helping - but only for big systems. Small clinics and rural pharmacies still get the leftovers.

Experts agree: without major changes, the number of U.S. generic manufacturers will drop from 127 in 2022 to 89 by 2027. That means fewer backups. Fewer options. More shortages.

One Harvard doctor put it bluntly: “We have a generic market that’s totally focused on price and not on product quality or supply chain quality.”

It’s not about making drugs more expensive. It’s about making them sustainable. If we want reliable access to essential medicines, we have to stop treating them like commodities. They’re not widgets. They’re lifelines.

What You Can Do

You can’t fix the system alone. But you can speak up.- Ask your pharmacist: “Is this generic made in the U.S.?” If they don’t know, ask why.

- Report shortages to the FDA’s Drug Shortage Portal. Every complaint counts.

- Support legislation that funds domestic manufacturing and improves oversight.

- Don’t assume “generic” means “safe and reliable.” Ask questions. Demand transparency.

Generics saved billions in healthcare costs. But if we keep squeezing them dry, we’ll lose them - and the people who depend on them.